Insurers are 'leaving money on the table' for some shoppable imaging services

Health insurance companies may be “leaving money on the table” when it comes to their payment negotiations for many common radiology exams.

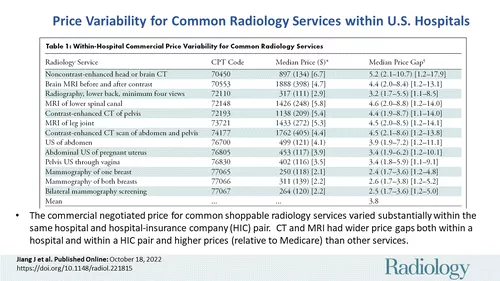

This was the conclusion experts came to after comparing the negotiated prices of 13 shoppable radiology services (as designated by CMS) from hospitals that disclose their prices. The analysis revealed that, in some instances, maximum negotiated prices were 3.8 times higher than the minimum negotiated prices at the same hospital for the same procedure.

Radiology published the study online Oct. 18 [1].

“Many commercial plans are leaving money on the table when negotiating price with hospitals, especially for expensive CT and MRI scans,” study corresponding author Ge Bai, PhD, CPA, a professor of accounting at the Johns Hopkins Carey Business School and colleagues shared. “High prices paid by commercial plans eventually come back to bite U.S. employers and workers through high premiums and out-of-pocket costs.”

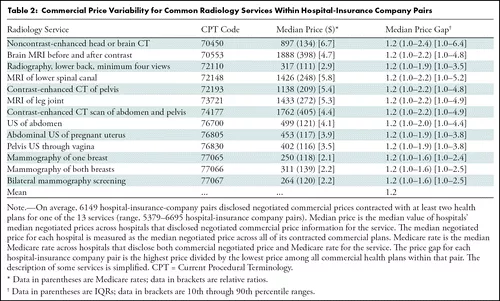

Sometimes, multiple insurance plans from the same insurance company are contracted within a single healthcare institution. In these cases, plans also had different negotiated prices for the same service, depending on the specific insurance plan.

The variances were widest when it came to certain CT and MRI studies. For brain CT scans, the maximum negotiated price was more than 2.4 times higher than the insurance company’s minimum negotiated price for 25% of hospital-insurance company pairs.

“Commercial prices for CT and MRI scans on average varied four- to five-fold within the same hospital and as much as high as nine- to 10-fold in a quarter of hospitals,” the authors reported, adding that prices negotiated by the same insurance company within a single institution can vary five- to six-fold across different insurance plans.

This study comes as hospitals are now required to comply with pricing transparency regulations enacted by CMS. Though these rules went into effect in 2019, as of early 2022, analytics indicated that just over 20% of organizations were complying at that time. For hospitals that comply, the CMS requirement brought to light the enormous price variations for a number of shoppable services, with the same study (CT, MRI, etc.) costing thousands of dollars more at one institution compared to another.

“Price transparency took the blindfold off the eyes of commercial payers, forcing them to recognize the fact that they are often paying too much,” the authors wrote. “Equipped with pricing information, radiologists can change the landscape of care delivery to benefit patients and payers.”

The authors noted that some hospitals opt for higher cost services, such as CT or MRI, because it implies higher profitability. In turn, the incremental clinical value of other lower cost services is disregarded and can lead to “inefficient” spending for both patients and payers, which appeared to be the case for some in this research, they suggested.

View the detailed pricing figures here in Radiology.